The Harvard Business School has just conducted its third alumni survey on U.S. competitiveness and finds “An Economy Doing Half Its Job.” “Our report on the findings focuses on a troubling divergence in the American economy: large and midsize firms have rallied strongly from the Great Recession, and highly skilled individuals are prospering. But middle- and working-class citizens are struggling, as are small businesses. We argue that such a divergence is unsustainable.”

Highlights of the survey are:

Highlights of the survey are:

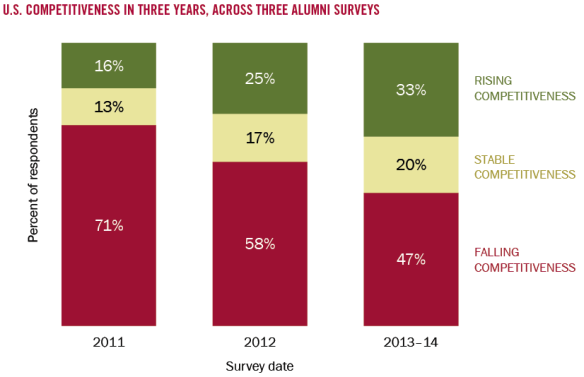

- Survey respondents were pessimistic on balance, although less so than in previous surveys. By a ratio of three to two, those who foresaw a decline in U.S. competitiveness in the next three years outnumbered those who predicted an improvement. Respondents were much more hopeful about the future competitive success of America’s firms than they were about the future pay of America’s workers.

- Respondents saw weaknesses in those aspects of the U.S. business environment that drive the prospects of middle- and working-class citizens, for instance, the education system, the quality of workplace skills, and the effectiveness of the political system.

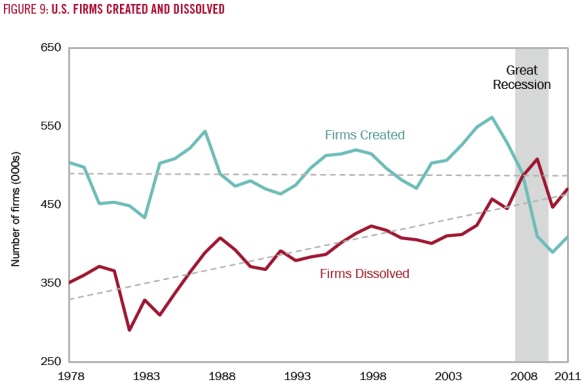

- Alumni working in small businesses had more negative views of virtually every aspect of the U.S. business environment. This finding echoes growing evidence from other sources that small businesses are disadvantaged in America.

The authors of the report “see a need for business leaders to move toward strategic, collaborative efforts that make the average American productive enough to command higher wages even in competitive global labor markets. Without such actions, the U.S. economy will continue to do only half its job, with many citizens struggling.” What’s interesting about this report is that it describes the problems of the American economy in a straightforward and practical way with no apparent ideological slant. Of course, addressing these issues requires political action with all of its messy, partisan overtones. Nevertheless perhaps all parties can at least agree on what the basic problem is.

The authors of the report “see a need for business leaders to move toward strategic, collaborative efforts that make the average American productive enough to command higher wages even in competitive global labor markets. Without such actions, the U.S. economy will continue to do only half its job, with many citizens struggling.” What’s interesting about this report is that it describes the problems of the American economy in a straightforward and practical way with no apparent ideological slant. Of course, addressing these issues requires political action with all of its messy, partisan overtones. Nevertheless perhaps all parties can at least agree on what the basic problem is.