The economist and public lecturer, Richard Wolff, gave an address in Omaha NE last night, entitled “Capitalism in Crisis: How Lopsided Wealth Distribution Threatens Our Democracy”. His thesis is that after 150 years, from 1820 – 1970, of steadily increasing worker productivity and matching wage gains, a structural change has taken place in our economy. Since 1970 worker productivity has continued to increase at the same historical rate while the median wage level has been flat with no appreciable increase. This wage stagnation has been caused by an imbalance of supply and demand as follows:

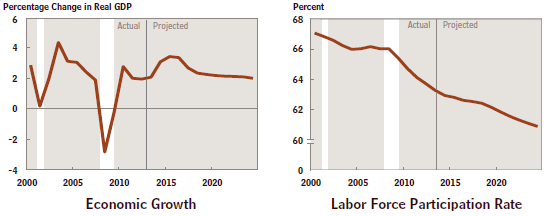

- Technology has eliminated lots of low skill and medium skill jobs in the U.S.

- Globalization has made it less expensive for low skill jobs to be performed in the developing world at lower cost than in the U.S.

- At the same time as jobs were being replaced by technology and disappearing overseas, millions of women entered the labor force.

- A new wave of Hispanic immigration has caused even more competition for low skilled jobs.

In addition, stagnant wages for the low skilled and medium skilled worker have been accompanied by an increase in private debt through the advent of credit cards and subprime mortgage borrowing. This enormous increase of consumer debt led to the housing bubble, its bursting in 2007-2008, and the resulting Great Recession.

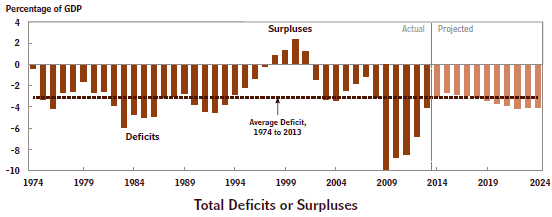

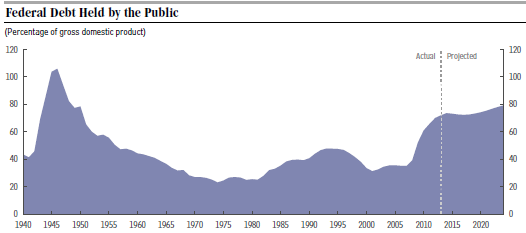

Five years after the end of the recession in June 2009, we still have an enormous mess on our hands: a stagnant economy, high unemployment, massive and increasing debt and a fractious political process. How in the world are we going to come together to address our perilous situation in a rational and timely manner?

Mr. Wolff believes that capitalism’s faults are too severe to be fixed with regulatory tweaks. He also agrees that socialism has proven to be unsuccessful where it has been tried. He proposes a new economic system of “Workers’ Self-Directed Enterprises” as an alternative.

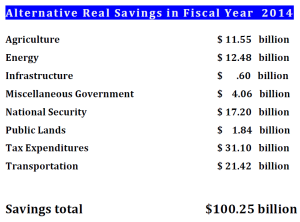

I agree with Mr. Wolff that capitalism is in a crisis but I think that it can be repaired from within. The challenge is to simultaneously give our economy a sufficient boost to put millions of people back to work and to do this while dramatically shrinking our annual deficits in order to get our massive debt on a downward trajectory as a percent of GDP. How to do this is the main focus of my blog, day in and day out!