In my opinion the two most serious problems facing the U.S. at the present time are 1) stagnant growth and 2) massive debt. As discussed by William Galston in yesterday’s Wall Street Journal, the U.S. presidential campaign is now beginning to address the first of these issues. For example:

- Bernie Sanders rejects “growth for the sake of growth” and says that “our economic goals have to be redistributing a significant amount back from the top 1%.”

- Hillary Clinton says that we have to build a “growth and fairness” economy. “We can’t create enough jobs and new businesses without more growth, and we can’t build strong families and support our consumer economy without more fairness.”

- Jeb Bush argues that there is nothing wrong with household incomes that 4% growth wouldn’t solve.

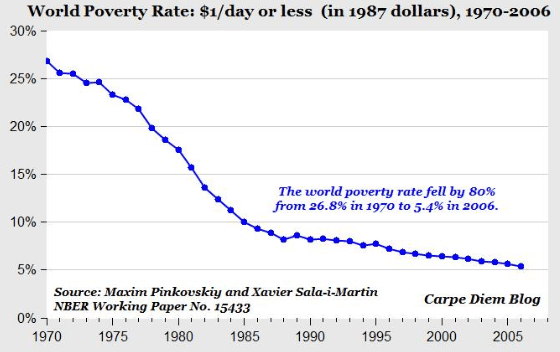

The readers of this blog will have little difficulty figuring out where I stand on this continuum of economic values. My view is illustrated by the chart just below from the World Bank which shows that countries with the fastest growing economies also have the least amount of inequality.

Let’s be more specific. Mrs. Clinton would achieve more fairness by:

Let’s be more specific. Mrs. Clinton would achieve more fairness by:

- Raising the minimum wage.

- Guaranteeing child care and other family friendly policies.

- Encouraging profit sharing.

- Encouraging more innovation by increasing public investment in infrastructure, broadband, energy and scientific research.

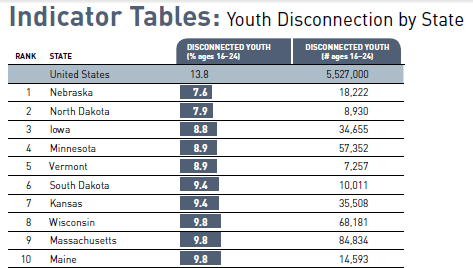

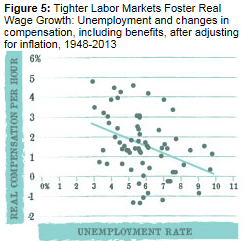

These are attractive goals but how do we achieve them? The best way to raise wages is to get the economy growing so much faster that it creates a labor shortage. Then businesses will be competing for labor and wages will go up. This is exactly what is happening in Omaha NE where I live and the unemployment rate is down to 2.9% (2.6% in Nebraska as a whole).

Furthermore, in a tight labor market, businesses will automatically try harder to keep good employees by providing extra benefits such as childcare and profit sharing.

Public investment in infrastructure, etc. will be more easily affordable with the higher tax revenue generated by a faster growing economy.

Conclusion: faster growth is the best way to create a more fair and equal society!